Currency Correlation in Forex is not a fixed affair! Beware!

For all traders out there, did you experience the change in currency correlation within the forex market this year (2019)? Did you get your fingers burned? Yes, in forex, every revelation comes with a price. If you’re a newbie, let’s take a tough rock out of your Forex foundation and replace it with a replacement wisdom today.

(Experienced traders, kindly scroll down!)

What is Currency Correlation in forex?

When one currency pair goes up, the other follows it up by getting into an equivalent direction or the opposite. it's called currency correlation.

If a currency moves in tandem with the opposite , then they both have a direct correlation . If the movement is precisely the other , it's a indirect correlation .

For instance, consider EUR/USD and GBP/USD. Since their movements are precisely identical, they need a direct correlation . Whereas, if you compare the EUR/USD with USD/CAD, you'll see a small indirect correlation .

Owning 1 lot of EUR/USD and 1 lot of GBP/USD is like owning 2 many EUR/USD as both will either hit the target or stop loss in tandem. So, traders need to remember of the correlated currency pairs because it could significantly increase the danger or might

be used as a wise hedging tool.

The reason behind currency correlation in Forex

There are three primary reasons for currency correlation.

#One – Clubbing

The currencies are clubbed as pairs. therefore the same currency appears in multiple pairs. When there's a requirement spike for a currency, it happens across the board. And traders line up of it against every pair.

Take the case of EUR/USD and GBP/USD. They both have USD because the common denominator. So when the USD becomes weak, they both go up, whereas, when the USD becomes strong, they plunge together.

#Two – Interdependency

Some economies are interdependent. Generally, this happens with neighboring countries, say Australia and New Zealand, the US and Canada. So, when one makes a move, traders naturally take a speculative position on the opposite to follow it up.

#Three – Risk

When the investors wary that the financial markets are in danger , they embrace safe-haven assets like USD, JPY, and CHF. But, when the market is at its best, and that they take the extra-mile of risk and acquire EUR, GBP, and AUD.

How to measure the currency correlation of forex pairs?

The formula to live the currency correlation is below.

Perplexed? No worries. there's a simple answer .

The spreadsheet has an inbuilt function (=CORREL). you'll use it to seek out the correlation of any asset class.

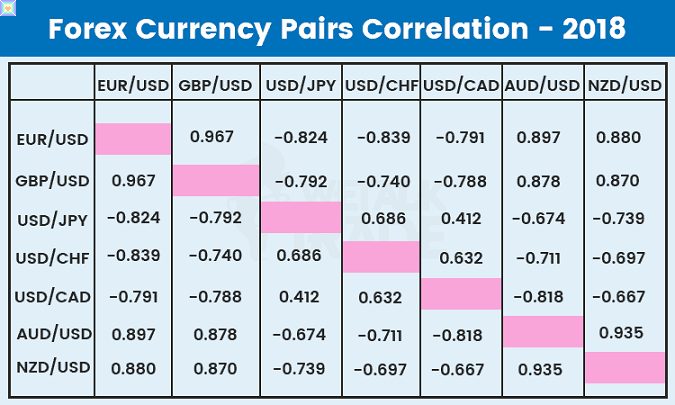

We have put down the correlation of all the main forex pairs for the year 2018. If the worth is on the brink of 1, then it's a direct correlation . On the contrary, the worth of -1 may be a indirect correlation .

Well, traders believed this correlation as a hard and fast affair within the forex market, until that point . And it had been a simple deal, back then. But, here is that the twist within the tale.

The Currency Correlations aren't fence carvings

The year 2019 had a big change within the store for us, traders. Some divorces and marriages happened , which could are shocking even to the fans of Game of thrones.